Questions from First-Time Buyers – Answered by Lloyd Wells Mortgages

Your home may be repossessed if you do not keep up repayments on your mortgage

All information was accurate at the time of publication.

What is a first time homebuyer?

A first time buyer is someone who is buying a property for the first time.

Some lenders are more strict than others. Some will need you to not have owned property at anytime, anywhere in the world.

Nationwide are one of the more lenient with their first time buyer definition and say: “Applicants who haven’t held a mortgage in the last three years (this includes UK and non-UK mortgages).”

How do I find out if I am a first time buyer?

Most people will know if they have owned property previously. If you are unsure if you have owned property previously, the best thing to do is speak with a solicitor and they will be able to make the checks on your behalf.

What is HMRC first time buyer definition?

HMRC define first time buyers as “an individual or individuals who have never owned an interest in a residential property in the United Kingdom or anywhere else in the world and who intends to occupy the property as their main residence.”

Can you qualify as a first-time buyer twice?

The quick answer is no. If you have owned property previously, then you are not a first time buyer. That being said, Nationwide’s definition of a first time buyer is “Applicants who haven’t held a mortgage in the last three years (this includes UK and non-UK mortgages).”

How do I know if I am a first time buyer?

If you have owned property previously, then you will not be a first time buyer. If you are unsure if you have owned property previously, it might be worth getting some legal advice from a solicitor. Nationwide define a first-time buyer as “Applicants who haven’t held a mortgage in the last three years (this includes UK and non-UK mortgages).”

What if I’m a first time buyer but my partner isn’t?

It depends why you want to be a first time buyer. If you want to qualify for a first time buyer product, it is likely that both of you will need to be first time buyers. This is the same for stamp duty discounts. You will both need to be first time buyers for a stamp duty discount. If you have a LISA, you should still get your 25% bonus on your savings if you’re a first time buyer, but your partner isn’t.

Are you a first time buyer if you have inherited a property?

If you have inherited a property, you are no longer a first time buyer as you own property. For most lenders, they class first time buyers as someone who hasn’t owned a property at anytime, anywhere in the world.

What is first time buyer relief?

First time buyer relief is for first time buyers and relates to the stamp duty that you will have to pay. Since the 22nd September 2022, first time buyers buying a home up to £425,000 in England and Northern Ireland do not have to pay any stamp duty. If you are buying a home for £425,001 to £625,000, you will pay stamp duty of 5%, but only on the value above £425,000.

Which loan is best for first time home buyers?

This is really dependent on your own personal situation. The best thing to do is speak with ourselves and we can go through all of your options, tell you how much you can borrow, what this will cost, what fees you can expect, we will discuss timescales with you, what documents you will provide and answer any questions you may have.

What are the qualifications for first time home buyers?

This is the same as for all home buyers. The lenders will want to assess your personal income, they will look at your expenditure, they will want to complete a survey on the property you wish to buy. Once they have done all of this, they will be able to provide you with a mortgage offer. You will also need a solicitor who will make sure that everything is done correctly to protect you and the mortgage lender.

Who has the best mortgage rates for first time buyers?

This changes every day. It is very rarely your own bank! We are able to recommend 76 lenders to you and they all change their rates depending on their own requirements, targets, service levels etc. The best thing to do is speak to ourselves and we can go through your requirements and find out which lender has the best rate specifically for you.

What is the best mortgage for a first time buyer?

This is unique to yourself. One first time buyer may want something completely different to the next. By speaking with ourselves, we can tailor our advice to make sure you are getting the best mortgage for you.

What happens if I don’t have a deposit for a first time buyer mortgage?

Recently, Skipton Building Society brought back 100% mortgages, which means that some people won’t need a deposit to purchase a property. They can be quite hard to qualify for though so ideally you would have at least a 5% deposit. It does get easier to apply for a mortgage if you can put down 10% and again easier if you can put down 15%. The best thing to do is speak with ourselves and we can help you put a plan in place to purchase your first home.

How much deposit do I need for a mortgage first time buyer UK?

In the UK, you will generally need at least a 5% deposit. Skipton Building Society are the only lender with a 100% mortgage, but they are very difficult to successfully apply for. Realistically, your chances improve with a larger deposit, so if you can stretch to a 10% deposit, 15% deposit or more, you will find that you have more options.

How much do you need to earn to get a first time buyer mortgage?

There is no minimum income required to get a mortgage. That being said, the lender will complete an income and expenditure assessment to make sure you can afford your mortgage. We find that you will need at least an income of between £15,000-£20,000 to get a mortgage. The best thing to do is speak with ourselves and we can look at how much you would be able to borrow.

How can I get a first time buyer mortgage with low income?

Lenders will assess several different types of income. They can look at employed income, overtimes, bonuses, commission, benefits, maintenance payments, etc. You might find it easier buying a property with a partner or family member as having two incomes will allow you to borrow more.

What are mortgage rates for first time buyers?

Mortgage rates for first time buyers will be individual to you. The best thing to do is speak with ourselves and we can go through your options and see what mortgage rates you could apply for.

What is the average deposit needed for a first time buyer in the UK?

There is no average deposit for first time buyers as such. Ideally you would have at least a 5% deposit, although Skipton Building Society do have a 100% mortgage. This can be hard to successfully apply for so we would suggest having at least a 5% deposit, but if you can stretch to 10%, or 15% deposit, you’ll find you have more options.

Where can I find more information about first time buyer mortgages?

We are happy to speak to you about first time buyer mortgages and answer any questions you may have. You can have a look online too and most banks will have sections specifically for first time buyers.

Where can I get advice on first time buyer mortgages?

You can speak to ourselves about first time buyer mortgages. We will go through your situation and recommend the best mortgage for you. If you are not quite ready to buy a house yet, we can help you put a plan together so you can get on the property ladder as soon as possible.

What do most first time buyers get wrong about their mortgage?

We find that a lot of first time buyers speak with their family and might get out of date advice from people who may have bought property in the 80’s when the landscape looked very different. One example is that a 25 year mortgage term isn’t written down anywhere as being the most suitable. A lot of people think this is the best mortgage term and will help them get a mortgage, but in reality you might find that a shorter or longer mortgage term is right for you.

It’s also worth have a contingency fund (if possible) so that if there are some hidden costs, you have a small pot to fall back on. Removals, surveys, solicitors, indemnity insurances can crop up when they haven’t been factored in at the beginning.

What are the biggest first time home buyer mistakes and how can you avoid them?

First time buyers are more likely to have credit issues from previous properties they’ve moved on from and not had the letters telling them they’re behind on payments. It’s always worth having a look at your credit file to see if there have been any historic credit issues and sorting them out before you buy your first home. Check My File look at Experian, Equifax and Trans Union in one and offer a free month. Please be aware that by clicking onto the above link you are leaving the Lloyd Wells Mortgages Limited website. Please note that neither Lloyd Wells Mortgages Limited nor PRIMIS are responsible for the accuracy of the information contained within the linked site accessible from this page.

How do mortgages work in the UK for first-time buyers?

Mortgages are loans secured against property. For First Time Buyers you are likely to have more underwriting completed as the lenders will see you as being higher risk compared with people who already own property. The best thing to do is speak with ourselves and we can guide you through the process and make sure you’re mortgage application is as easy as possible.

Do first time home buyers need a deposit?

Yes, you will need a deposit of at least 5% of the property value. Skipton Building Society do have a 100% mortgage, but it can be difficult to apply for. The larger your deposit, the easier you will find it to apply for a mortgage. If you can put down a 10% or 15% deposit, you will have more chance of getting a mortgage.

What is needed for a first time home buyer to qualify for a great mortgage rate?

To put yourself in the best position possible as a first time buyer, you will have a good income, little debt, a good deposit, a clean credit history and to purchase a standard property. If your family can help you with paying off debt, or contributing to your deposit, that can really improve your chances of getting a mortgage.

What is the best advice you would give to first time homebuyers?

Get your ducks in a row! What I mean by this is you need to be prepared. You want to know how much you can borrow, what that’s going to cost, what fees to expect before you start property hunting. When you do start property hunting, you need an agreement in principle. This is a certificate from the lender confirming how much you can borrow. If it’s between you and another buyer putting in an offer on the same property, the one with the agreement in principle is the one who will have their offer accepted. Speak to ourselves and we can look after all of the above for you.

What mortgages can a first time buyer get?

First time buyers can get all sorts of mortgages. The best thing to do is speak with ourselves and we can go through your options and find the best mortgage for you personally.

How does getting a mortgage work if you are a first time buyer?

If you are a first time buyer, the lenders will want to give you a thorough assessment. They’re going to look at your income and your outgoings to make sure that the mortgage is affordable. They’re going to survey the property to make sure that it is ok. They’re going to need solicitors to complete legal checks to make sure that everything is completed properly. The best thing to do is speak with ourselves and we’ll be able to answer all your questions and make sure you are fully prepared.

What deposit is needed for a first time buyer?

You will generally need at least a 5% deposit. If you can stretch to a 10% or 15% deposit then you are more likely to get a mortgage. Skipton Building Society does have a 100% mortgage currently, but they are difficult to apply for.

How to find your first time buyer mortgage?

The best thing to do is speak with ourselves and we’ll be able to help you find the best first time buyer mortgage for you. We’ll go through your affordability, what your plans are for the future and be able to put a recommendation together specific for you.

How long should I fix my mortgage for if I’m a first time buyer?

Generally there are 2, 3, 5 and 10 year fixed rates. There are other variations, but these are the most common. Most people look at both the 2 and 5 year fixed rates as these tend to be the most competitive. The 2 year fixed rate might be more appropriate for people who want to review their mortgage more often and might want to move within 5 years. The 5 years might be more suitable for people who want to have slightly longer security. They don’t want to have to review their mortgage every 2 years. When we speak with you, we will go through all your options and discuss which is the best fixed rate for you.

How to find your first mortgage?

The best thing to do is speak with ourselves and we can help you find your first mortgage. We’ll look at all your options and provide you with a recommendation specific to you.

What type of first time buyer mortgage should I choose?

This will be individual to you. The best thing to do is speak with ourselves and we can have a look at what is important to you. We can look at what product is right and which lender will be best suited. As the lenders change their rates regularly, this might change quite quickly.

Can I afford a mortgage?

This will be individual for you, but very quickly we can run through an affordability calculation so you know how much you would be able to borrow. We can then look at how much this is likely to cost. We can look at different mortgage terms, to fit your budget. Don’t think you have to have a mortgage over 25 years.

What are first time buyer mortgage affordability checks?

When checking your affordability, lenders will want to know about all of the income you receive. They will also look at your outgoings, such as student loan payments on your payslips and if you have any debts such as credit cards or car loans. If you are buying a flat, they will look at the ground rent and service charge you will have to pay.

What first time buyer mortgage fees will I have to pay?

Each lender will have different fees. For a typical mortgage I would expect an arrangement fee of around £995 which you can add to the mortgage or pay from your savings. Some lenders charge a booking fee of £199 or £250, but this isn’t as common for first time buyers. You might have to pay a valuation fee of £100, but a lot of lenders pay for a basic survey and some will even give you cashback on completion of between £250 and £500. When we make our formal recommendation, we will talk you through all of the fees that are payable and when you have to pay them.

Do I need a big deposit for a first time mortgage?

The minimum deposit is 5% of the property value. If you can stretch to 10% or 15% of the property value, you will find it easier to get a mortgage. Skipton do have a 100% mortgage, but they can be difficult to apply for.

Will lenders give a first time buyer mortgage on any property?

Most first time buyers looking to buy a house or flat and have little issues getting a mortgage. The property will need to be in a habitable state, which means it is watertight with water and heating and a working kitchen and bathroom. Certain properties can be more difficult such as concrete houses or flats above commercial premises. Some lenders such as Nationwide will need a deposit of 15% on flats. The best thing to do is send us a copy of the Rightmove link once you have found a property and we can quickly tell you if you will have any problems getting a mortgage on that property.

How to find the best mortgages for first time buyers?

The best thing to do is speak with ourselves and we can find the best mortgage for you. What is best for one person, might not be the best for another. We can tailor our recommendation so you are getting the best possible mortgage for you.

How does a mortgage rate work?

Mortgage rates are set by the bank and building society and are either fixed or variable. Fixed rates are the most common and they will remain the same, regardless of what happens, for a set period, usually 2, 3, 5 or 10 years. Variable rates can either track the Bank of England Base Rate or be set independently by the lender. They are generally higher risk as rates could rise and your mortgage could become more expensive. We will guide you through what is available to you and make sure you understand the mortgage we are recommending and that it is right for you.

What happens after my first time buyer mortgage offer is issued?

Once the lender has completed underwriting your mortgage application, if you are successful, they will produce a mortgage offer. It confirms all of the details of your mortgage. These are typically valid for 3-6 months. You will receive a copy, we will receive a copy and a copy will be sent to your chosen solicitor. The solicitor will then complete all their checks and may need further information from you. They will set everything up for exchange, when you become the legal owner of the property, and completion when you get the keys.

How are first time buyer mortgages different?

First time buyer mortgages are very similar to other mortgages. Most lenders will give first time buyers a little benefit to entice them in. Nationwide have a Helping Hand mortgage for first time buyers where they can lend up to 5.5 times your income in certain circumstances. They may also throw in a free valuation and cashback of between £250 and £500. We’ll always recommend the best mortgage for you.

Should I add the cost of product fees to my first time buyer mortgage?

Most products will have an arrangement fee of around £995. This can be added to your mortgage or you can pay it up front from your savings. It’s up to you which you would prefer. If you add it on, your mortgage will be marginally more expensive and you will pay interest on the fee over the entire term of the mortgage. But it means you won’t have to find another £995 which might be better used buying furniture, or decorating your new home. It won’t impact your application, in as much as paying it upfront or adding it on won’t make it more or less likely of your application being successful.

How to prepare for your first time buyer mortgage application?

The best way to prepare for your mortgage application is to make sure you have all your documentation. Make sure your driving licence and bank statements are registered to the correct address. Make sure you’re able to produce 3 payslips and bank statements. Have a look at your credit report and make sure there are no errors. Check My File look at Experian, Equifax and Trans Union in one and offer a free month. Speak to ourselves before you start viewing property to make sure you are able to get a mortgage.

How does a fixed rate first time buyer mortgage work?

A fixed rate does exactly what it says. The rate that you pay is fixed for 2, 3, 5 or 10 years. Regardless of what happens to interest rates, your rate will stay the same. This means you can budget and be confident that you can afford your mortgage.

What happens at the end of my first time buyer mortgage deal?

Most first time buyers will take a product that ties them in for 2, 3 or 5 years. If you use our services, we will call you back 6 months before the end of your mortgage. We’ll do what is called a remortgage. This is where we look at your new situation and recommend a new product specific to then. It might be that you want to move house, or borrow more for home improvements. It might be that you want to pay off a lump sum. You might stick with the same lender or it might make sense to change to a new lender. We’ll explore all of the options for you and go through a similar process to make sure you get the best mortgage possible next time.

How to improve your chances of getting a first time buyer mortgage?

The best way is to speak to ourselves early and we can look at your chances of being approved for a mortgage. It might make sense to pay down some of your debt, or continue to save until you have a certain deposit. You might not have been in your job long enough or you might have some historic debt issues which won’t be considered after a certain amount of time. By speaking with ourselves we can guide you through your options.

What is a guarantor mortgage?

Guarantor mortgages are where a third party, usually a parent, is named on the mortgage so that should you be unable to pay your mortgage, they can step in and make the payments on your behalf. They guarantee the mortgage payments will be made.

They don’t exist anymore, but have been replaced by joint borrower, sole proprietor mortgages.

This is where your parents are on the mortgage with you, but they aren’t on the deeds of the property. The benefit to this is that if they already own a property, you won’t have to pay any additional stamp duty. You can also use their income to borrow more than you would be able to afford on your own.

The negatives are that it will count as a commitment for them, so if they need any credit in the future, the whole mortgage payment will be seen as their liability. Their own debts will also need to be considered when applying for the mortgage. If they have their own mortgage and loans and credit cards, they may not be able to afford a second mortgage.

Another thing to consider is that most mortgage need to end by 70. If your parents are a little older, then you might have to take a shorter mortgage term, which will mean higher monthly payments. The slight benefit to this is you’ll pay less interest in the long term.

How much deposit do I need to buy a home?

In the UK, you will generally need at least a 5% deposit. Skipton Building Society are the only lender with a 100% mortgage, but they are very difficult to successfully apply for. Realistically, your chances improve with a larger deposit, so if you can stretch to a 10% deposit, 15% deposit or more, you will find that you have more options.

What is a mortgage survey?

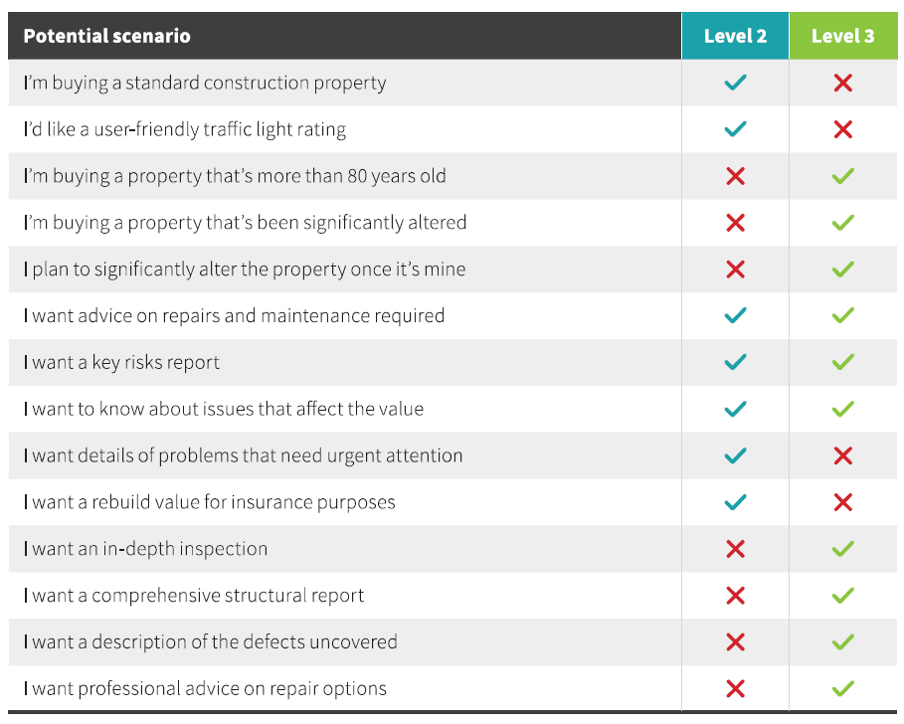

As part of a property purchase, you will need to have a survey completed. Usually, the lenders will contribute towards a basic survey (Level 1) and offer it for free of £100. This will confirm you are paying a fair price, that it is mortgageable and what the rebuild cost would be for insurance purposes. This survey is for the lender though and they don’t have to provide you with a copy.

We generally recommend getting at least a RICS Homebuyers Report (Level 2). The cost of this is relative to the purchase price and we can quickly tell you what this is when we know how much your buying your new home for.

With this report, they’ll look at the electrics, the roof, the windows, the boilers etc. If there are any issues, they will make you aware of them. You can then use this information to continue with your purchase, reduce the price if work is needed, or simply walk away from the property if there are serious problems. There is no legal redress, so if they miss something, you can’t sue them.

There is also a RICS Building Survey (Level 3), often called a full structural. This is too much for most purchases, but if you were buying a listed property, or something which has had significant alterations, you will want this survey. It is more expensive, but it goes into a lot more detail again.

When will I get my mortgage offer?

Each lender has their own timescales. We will confirm how long it is taking for the lender to assess applications at the point of application. Some lenders will really pull applications apart and some will ask less questions. As part of our process we will find out what is important for you. Some people might be happy to pay a little extra for a quick and easy application, others might not have a choice and go for the more thorough lenders.

As a rule of thumb, we expect an application to take 10-15 working days to underwrite. You’ll also need a survey completed on the property which is separate from this. If the lender is able to complete a virtual survey, it might be instant. If they need to send out a surveyor at a particularly busy time, it may be a couple of weeks.

We like to see mortgage offer produced within a month, although it can be longer than this.

It can also be shorter than this if you are in a rush.

What are fixed-rate mortgages?

A fixed rate does exactly what it says. The rate that you pay is fixed for 2, 3, 5 or 10 years. Regardless of what happens to interest rates, your rate will stay the same. This means you can budget and be confident that you can afford your mortgage.

What are tracker-rate mortgages?

Tracker-rate mortgage are variable rates that track the Bank of England Base Rate. They are generally higher risk as rates could rise and your mortgage could become more expensive. We will guide you through what is available to you and make sure you understand the mortgage we are recommending and that it is right for you.

What are interest only and repayment mortgages?

There are two ways or repaying a mortgage, interest only and repayment.

With interest only, you are only paying the interest and the balance of the mortgage won’t reduce.

Most first time buyers are unable to apply for an interest only mortgage as they generally require large deposits and high incomes.

Repayments are more common and this is where you are guaranteed that your mortgage will be repaid at the end of the mortgage term.

How an expert mortgage advisor can help

Most people don’t know that much about mortgages. Historically, you might have just gone to your bank and taken a mortgage over 25 years. This generally isn’t the right thing to do! By speaking with an expert mortgage advisor we can tailor our recommendation to you so you can be sure that you are getting the best possible mortgage for you. We also manage the application and will chase the lenders, estate agents and solicitors to make sure everything goes through as quickly as possible. You won’t have to spend hours on hold to lenders or answer simple questions that they ask. You should receive your mortgage offer more quickly by using a mortgage advisor over doing things yourself too.

Are there any specific mortgages for first-time buyers?

Yes there are. lots of lenders offer specific first time buyer mortgages. These might have lower rates, smaller fees, free valuations or cashback to help with the cost of solicitors. You can speak to ourselves about first time buyer mortgages. We will go through your situation and recommend the best mortgage for you. If you are not quite ready to buy a house yet, we can help you put a plan together so you can get on the property ladder as soon as possible.

How a broker can help first-time buyers choose the right option?

As mortgage brokers, we will sit down with you and go through your situation in detail. We’ll find out what is important you and what you want from your mortgage. Once we have all of this information we can search for the best mortgage for you. This means you can be confident that we have chosen the right option for you and you will have peace of mind knowing that your mortgage is affordable.

Your home may be repossessed if you don’t keep up with your mortgage payments.