Your home may be repossessed if you do not keep up repayments on your mortgage.

Think carefully before securing other debts against your home; your home may be repossessed if you do not keep up repayments on your mortgage.

Housing Market Hurdles – Advice on Mortgages for First Time Buyers

It goes without saying that 2020 has been an extraordinary year, one that we have never seen the likes of before. At Lloyd Wells Mortgages, we speak to first-time buyers every day and know what problems they face climbing onto the property ladder. With Covid19 wreaking havoc with everything in its path, it has made buying your first property even harder.

Why are there no 90% Loan to Value mortgages?

Without a shadow of a doubt, the hardest part of getting on the property ladder is saving up a deposit. With the average price of a home bought in the UK by a first-time buyer being £231,500 in 2019, it’s easy to see why that would be. Before March, every high-street bank worth their salt was able to offer mortgages with a 5% deposit. On the example of £231,500, this would be £11,575.

At the time of writing, there are no products available that allow you to purchase your first home without putting down at least a 15% deposit (ignoring help to buy, shared ownership, shared equity, etc. that we’ll come on to shortly).

For a property valued at £231,500, you would need at least £34,725 as a deposit. This is an increase of £23,150 compared with what you would have to put down in February 2020.

There are several reasons why the mortgage market has withdrawn from the 90% and 95% loan to value arena and this list isn’t exhaustive:

- With the furlough scheme coming to an end on 31st October, there is a very real possibility that we are yet to see the worst of the job losses. Jobs that were once considered secure, are now considered insecure. This means that there is a very real risk of incomes dropping, as people take whatever jobs are available, change careers, or take career breaks. To reduce the risk to the banks, buyers must put down a larger deposit.

- Are we in a property bubble? The UK wason full lockdown from March 23rd to May 10th, roughly seven weeks. Most people continued to isolate throughout the rest of the summer. With families stuck in properties without enough bedrooms, no gardens, far from family, but also unable to do anything about it, when the lockdown was lifted we saw a wave of people deciding to move, regardless of cost. Due to this, properties with gardens, out of the cities, a 4th box room which could be turned into a home office, shot up at price. There is a real risk than in 6 months, 1 year, 2 years when things have returned to normal, that people will have spent too much on these properties. To reduce the risk to the banks, buyers must put down a larger deposit.

- Interest rates are at an all-time low, with the Bank of England base rate at 0.1% and reports that the UK might see negative interest rates in 2021. The reality is that in 2 years’ time, the base rate will begin to rise. Although mortgages are affordable currently, with incomes looking like they might reduce and interest rates looking like they might increase, we could see a lot of people being unable to afford their mortgage in the not too distant future. To reduce the risk to the banks, buyers must put down a larger deposit.

- Working from home. Boris Johnson, in his statement to the country, told the nation that if they can work from home, they should. With Banks and Building Societies being huge businesses, their underwriters, case handlers, and call centers are often packed into large offices. Due to this, the majority of them will have to work from home for the foreseeable future. This means that they are working on laptops that have to link to the servers in their offices on broadband that was only meant for Netflix. Whereas they used to be able to look at a hundred applications a day, they are now only able to look at 50. This has led to Building Societies taking 11 working days to assess documentation and the Nottingham Building Society withdrawing their products completely to catch up with their workload. To manage their workload, they have removed their high loan to value products.

What schemes are available to help me get on the property market?

Which mortgage to choose? Without having a 15% deposit, you will have to find other ways of purchasing your first home. A lot of first-time buyers we speak to have a romantic idea that they will buy a property that was lived in by an old couple that needs a bit of TLC and brought into the 21st century. Although this is great if you can achieve it, more realistically your first home might have to be a new build property using the Help to Buy scheme, Shared Ownership scheme, or Shared Equity scheme.

The Help to Buy scheme is the most common. The Help to Buy scheme works by providing equity loans on new build properties up to the value of 20% of the purchase price of properties outside London and 40% of the purchase price of properties in London. Originally, the scheme was only meant to run for 3 years, but it set to run until March 2023 for First Time Buyers.

We have written a handy blog on the Help to Buy scheme which you can find here.

Shared Equity and Shared Ownership schemes are very similar. They allow you to purchase a property you might not have otherwise been able to afford, by purchasing with a housing association.

With the shared equity scheme, you would purchase a percentage of the property and you would take an equity loan from a housing association. You usually wouldn’t make any repayments on the loan, but when you come to sell the property, that same percentage would be recouped by the housing association.

As an example, if you bought 50% of a £200,000 property, with the other 50%, £100,000 being an equity loan, you wouldn’t pay any rent on the £100,000 equity loan. When you come to sell the property in the future. If the value has increased to £250,000, you would repay the housing association 50%, £125,000, and the other £125,000 would be yours.

With the Shared Ownership scheme, you buy a share of your home (between 25% and 75%) and pay rent on the rest.

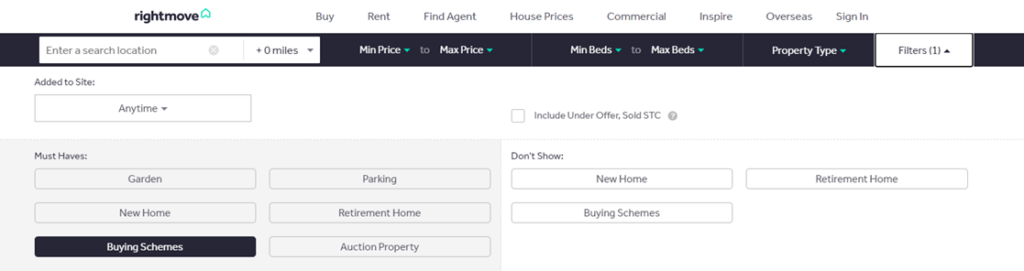

To be able to find these properties, you need to select the buying schemes button in the filters, on Rightmove

Be careful as some schemes are only available to people aged over 60.

Making sure your credit score is as strong as possible.

There’s nothing to be ashamed of if your credit score isn’t 999. You’re a first-time buyer, you don’t have a decades worth of mortgage payments behind you, how are you supposed to have a perfect credit score?

What you can do is make sure that you’re not going into your overdraft each month, that you are on the electoral roll, that you try and pay your credit card off each month, that rather than having three loans, you speak to your bank about consolidating them into one manageable loan.

We recommend Check My File as our preferred credit agency as it produces a really detailed, yet easy to understand credit report. It shows you what information Equifax, Experian, and TransUnion have on you to make sure that nothing is missed.

By increasing your credit rating, you maximize your chance of getting the mortgage you need. If your credit rating isn’t as high as it could be, there are lenders who will say that they can help, but you’ll need to put down a larger deposit.

Picking the right property

As I mentioned earlier, this isn’t yours forever home. This is a stepping stone property, on the way to your ideal home. That being said, you want to make sure that what you are buying is acceptable to the lenders. Some of the things to look out for when you are buying a property include:

- Is the property close to commercial premises? The lender will consider that if whatever reason you are unable to pay your mortgage and they needed to repossess the property, how easy will it be for them to quickly sell it. Due to this, they are unlikely to accept applications on properties next to restaurants and beauty salons due to the smells they produce, pubs, clubs, and corner shops due to their opening hours and antisocial behavior that often occurs outside them, above high street shops due to the added risk of burglaries. Instead, it’s worth concentrating on properties that are in residential areas away from commercial properties.

- For flats, the lender will want to see a long lease on the property. Although there are plenty of lenders who can help with a lease below 100 years, your options will start to reduce. You also want to make sure that the ground rent and service charges aren’t too high as this can be something that the underwriters will consider.

- Is it close to a river? We have had clients buying beautiful solid, houses with a babbling brook at the bottom of the garden. They have been declined by the lender because if the brook bursts its banks, the house will flood.

- Is there a history of subsidence? If the property has large cracks visible, the surveyor will request a structural survey that you will have to pay for. If it reports that the property is structurally unsound, then you will not be able to get a mortgage on the property.

- Is the property brick built with a slate roof? If not, then the lenders will want more information. Concrete built properties and steel framed properties can cause extra problems.

- Does the block of flats have cladding? Due to the heart-breaking disaster at Grenfell Tower in 2017, lenders will look at the cladding on the outside of buildings in a lot of detail. They will want to see that it is safe and has all the correct safety certificates. This can be expensive and time-consuming if they’re not readily available.

Next Steps

If you are thinking of buying your first home and need some advice on mortgages, then do give us a call on 0117 332 5333. Our initial conversations usually last around 15 minutes.

Alternatively, you can email enquiry@lloydwellsmortgages.co.uk and let us know how we can help you.

We will discuss:

- How much you can borrow

- What that will cost

- What fees can you expect?

- How Lloyd Wells Mortgages work

- What insurances you will need

- What documentation you will need to provide

- Next steps

Your home may be repossessed if you do not keep up repayments on your mortgage.