Your home may be repossessed if you do not keep up repayments on your mortgage.

How to borrow 5.5 times your income as a first-time buyer and will I need to sell my car to do it?

How to borrow 5.5 times your income as a first-time buyer and will I need to sell my car to do it?

Before you get giddy and think that you’ll be able to buy a mansion, I want to forewarn you that there are a few hurdles to jump.

The good news is that for a number of people, you may be able to borrow 5.5 times your income, with as little a 5% deposit. I’m a big believer of ‘if something sounds too good to be true, it probably is’, but in this instance, it may not be.

In reality, most lenders limit their income multiples to 4.5 or 5 times your income. They may say that they don’t use income multiples and that they actually have a detailed affordability calculator, but at the end of the calculator, it will say you can borrow 4.5 times your income. They are also more conservative with their lending limits at the higher loan to value thresholds. This means that you may not be able to borrow as much as 4.5 times your income if you only have a 5% or 10% deposit.

If you speak to a mortgage broker at a new build development, or at an estate agent, they are likely to recommend Halifax due to Halifax’s fantastic service. The big problem with this is that they are not usually the most generous. (How many of you are now thinking about your Halifax mortgage and if you truly got the best mortgage?)

Nationwide’s Helping Hand Mortgage

They’re well-advertised and if you do a Google search on them, there will be lots of information available.

They are head and shoulders above the rest of the market at the moment for the amount they’ll lend and we recently had a conversation with Nationwide who told us that their ‘Helping Hand’ scheme isn’t going anywhere, anytime soon!

How do they work?

Remember when I said there were a few hurdles to jump? Here we go!

Number 1, you have to be a first-time borrower. If you already own a property and you’re looking to remortgage or move house, tough luck. This isn’t for you. Don’t worry about those years of reliable mortgage payments and the equity you’ve built up. This one is for the kids who cancelled their Netflix accounts and stopped buying avocados.

Number 2, you have to be employed. If you are self-employed then you are too much of a risk. If you started a business just before a global pandemic, succeeded against all the odds and have several years of good accounts, then they are unable to help (I‘m not bitter, honest!).

Number 3, you have to be earning a certain amount of money. If you are buying on your own, then you need to be earning £37,000, if you are a couple you need to be earning £55,000 between you. The good news is that this is all income, so if you have £31,000 basic income, £5,000 from bonus and commission and £1,100 from child benefit, you earn £37,100 and you would be eligible.

Number 4, you need to apply for a 5 year fixed rate or 10 years fixed rate. This isn’t available for the 2 year fixed rates they have on offer. The longer fixed rates are less risk for the building society and it’s this reduced risk that allows them to lend you more money.

Let’s work this through an example. Don’t worry, I’m going to keep the numbers simple.

If you are earning £37,000 and want to buy a £250,000 property over a 25-year term, Nationwide will lend you £166,200 if you wanted a 2 year fixed rate.

If you go with Halifax, they will lend you £166,130 with the same figures.

If you go with Nationwide’s 5 years fixed rate, helping hand product, they can lend you £182,700, £16,500 more than the 2 year fixed rate.

You’re probably thinking, £182,700 isn’t 5.5 times £37,000 though.

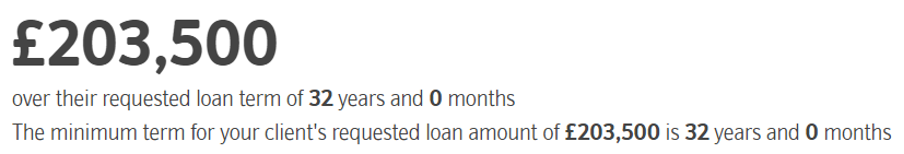

If we increase the term from 25 years to 32 years then they would now be able to borrow £203,500, or 5.5 times their annual income of £37,000.

Is this still available with a 5% deposit?

If £203,500 is 95% of the property value, then the 5% deposit is £10,710.52. Let’s round it up to £11,000, just to make the numbers a bit easier. This would mean a purchase price of £220,000.

Nationwide would still allow you to borrow £203,500 over 32 years with a 5% deposit.

What was this about selling my car?!

We recently had a very interesting scenario where our client had a car allowance from their employer of £500 per month and leased their car for £475 per month.

If we add a car allowance of £6,000 per year on top of the £37,000 income above, you would now be able to borrow £236,500.

If we include a car lease of £475 per month, the maximum you would be able to borrow is now £191,100!

Despite earning £6,000 more, and a car costing £5,700 per annum, you would be able to borrow £45,400 less than if you didn’t lease a car.

I’m sure in this instance you would quite happily return the car, borrow the £236,500 and maybe look at a little cheaper motor!

Next Steps

If you are looking to borrow as much as possible the best thing to do is to book in an appointment and we can run you through your options.

Do give us a call on 0117 332 5197. Our initial conversations usually last around 15 minutes.

Alternatively, you can email enquiry@lloydwellsmortgages.co.uk and let us know how we can help you.

We will discuss:

- How much you can borrow

- What that will cost

- What fees can you expect

- How Lloyd Wells Mortgages work

- What insurances you will need

- What documentation you will need to provide

- Next steps

The demonstration and example of lending are correct at the time of pubslishing.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Contact us and we can help you find the perfect mortgage.